AUTHOR: Jesus Urios

Bank deposits increased rapidly in the EU in 2020. This is linked with the uncertainty caused by the COVID-19 pandemic. How can public institutions help align consumption decisions to the EU’s climate ambitions?

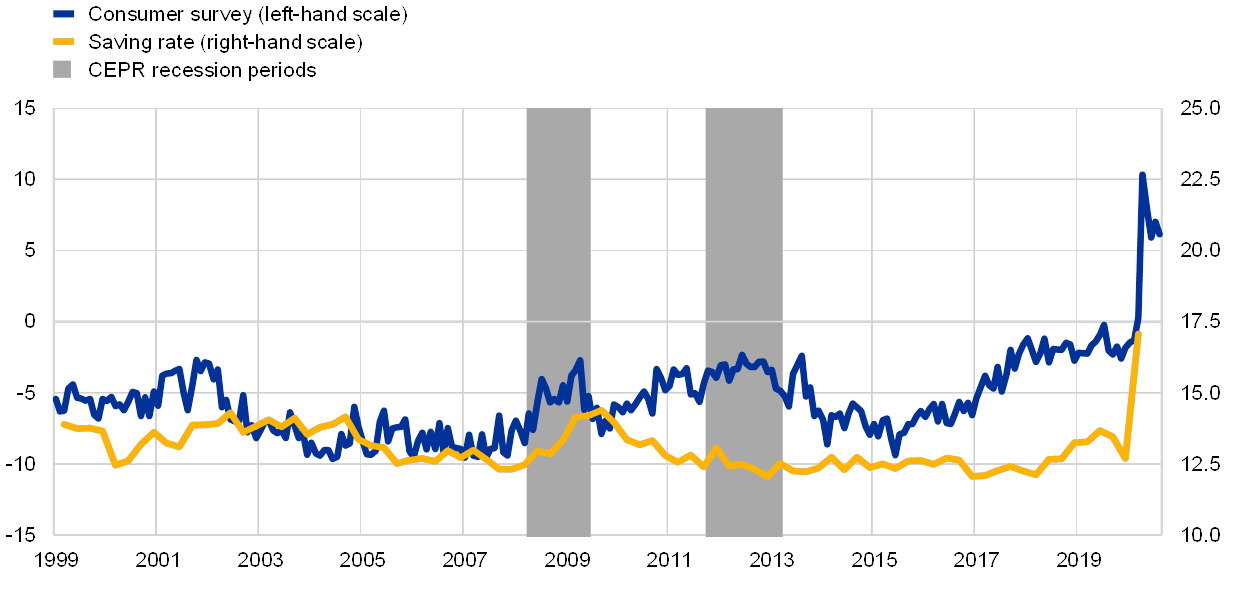

Since the beginning of the COVID-19 pandemic in 2020, bank deposits have increased rapidly in many European countries. Many European citizens are saving to levels not seen before. The uncertainty caused by the effects of the pandemic prevented or, at the least, postponed purchasing decisions for many households. In Q2 2020, the household saving rate increased to 23.9% in Q2 2020 compared with 15.6% in Q1 2020 in the EU27.

This trend will tend to dissipate following the reactivation of the economy when lockdown measures slowly disappear as vaccination progresses. In fact, saving rates were particularly high during the first months of the pandemic and progressively slowed down as deconfinement progressed. During Q3 2020, the average household saving rate was already down to 16.1% in the EU27.

|

Source: ECB, based on DG ECFIN and Eurostat calculations

This pattern is followed worldwide. Consumers in the world’s largest economies have saved around EUR 2.4 trillion during the pandemic. This is particularly telling when compared to the EUR 1 trillion estimated to be needed to finance the European Green Deal. These huge amounts of savings represent a lifetime opportunity to redesign our economies.

The sudden growth of savings among Europeans is directly linked with the uncertainty caused by the pandemic and not due to a new financial culture among Europeans. We have to bear in mind also that in the context of interest rates close to zero, saving is not encouraged either by central banks. Hence, we can assume that this amount of savings will be unlocked for spending and investment sooner or later.

Within this context, how can governments and institutions promote and enhance green investment options, in order to align investment decisions to the EU’s climate ambitions?

They can and they should. In fact, examples of such schemes are already in place across Europe. Several countries such as the Czech Republic, Germany, Italy and the Netherlands offer tax deductions for purchases related to energy efficiency or low/zero carbon technologies for small businesses. Tax breaks for the purchase of ‘green’ vehicles are applied in various EU countries. The Dutch SDE+ program provides tax incentives for individuals and private investors who choose to invest in ‘green funds’. Portugal provides up to 50% reduction on municipal property taxes applicable to buildings used for the production of renewable energy. In Sweden, the government subsidises the installation of solar PV panels and provides tax deductions for renewable electricity sold in the grid.

The EU has the opportunity to decisively support reforms in this direction. On February 10th, the European Parliament gave its approval to the Recovery and Resilience Facility (RRF) as part of NextGenerationEU, aimed at mitigating the negative economic effects of the COVID-19 pandemic and contributing to the digital and sustainable transitions. After the necessary formal approval from the Council, national governments will have until the 30th of April to submit their plans.

The European Commission, and more specifically DG REFORM and DG ECFIN, should issue recommendations in the RRF framework to incentivise the channelling of accumulated savings towards investments that contribute to the Paris Agreement’s objectives.

More specifically, the EU should promote market-based instruments that encourage citizens to contribute to the green transition, such as tax breaks for green investments, or by engaging with Member States and the ECB to issue green deal bonds for citizens to invest in.

In addition, although an appropriate regulatory framework has been established under the EU Taxonomy for investments, individuals are not likely to be aware of its implications. For instance, according to research by the Pensions and Lifetime Standards Association (PLSA), 59% of savers are unaware of the steps their workplace pension schemes are taking to tackle and reduce the impact of climate change and another 15% believe their schemes are ‘doing something’. The EU must introduce measures to make sure citizens are fully aware of the sustainability implications of their investment decisions. To make this happen, the involvement of the banking and finance sectors is key to offer consumers the appropriate tools and knowledge to make investment decisions in a sustainable manner.

For the EU, aligning the NextGenerationEU recovery plans and the unlock of accumulated savings by European consumers with sustainability will be necessary to achieve the European Green Deal goals.

This will require increased levels of transparency and information available to consumers, appropriate instruments at the EU and national levels and the engagement of the finance sector. It is also an opportunity to engage citizens with the European Green Deal by empowering them to make more conscious and well-informed decisions.